These days, it’s not uncommon for consumers to choose a bank based on their price competitiveness rather than their messaging. Why? Because lenders are looking a little the same…

So instead of mirroring competitors, how can businesses within the financial space break out of the mundane and get creative? Content doesn’t have to be restricted to ‘Save money by doing this’ or ‘Get rich by doing that’. In fact, with readers becoming more and more conscious of misleading messages, taking the time to create something more unique and bespoke is what will set you out from the crowd.

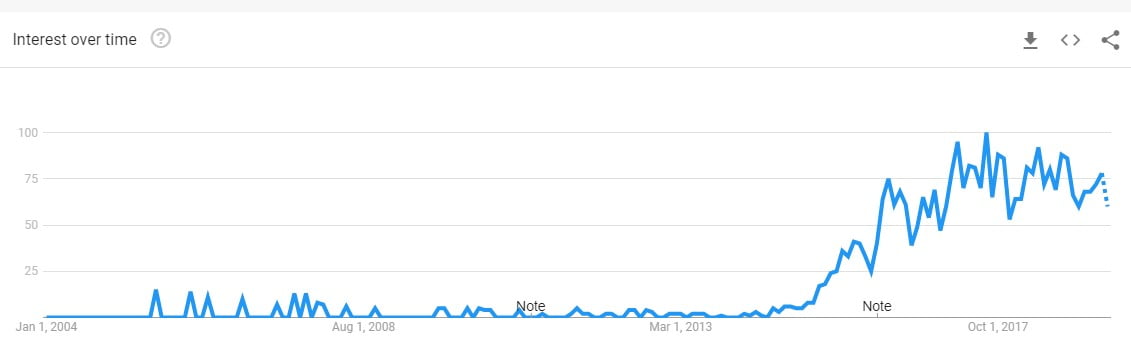

The rise of fintech

Melbourne has constantly been named Australia’s Silicon Valley. Now, the city is home to an abundance of companies that have hit their three-year mark, of which 43% of them are financial technology-related businesses (known as fintech). But with this surge of innovative, fresh players in the industry comes the risk of the same promises and messages to the consumer. Luckily, the fintech landscape has given rise to turning the ‘stale’ traditional history on its head, pushing it into more outside-the-box offerings.

More competitive than ever before, the barriers to success are also rapidly evolving. So whether you’re a rising fintech startup or a well-established lender – how do you tap into an audience who’s bored of tired content?

Understanding financial content marketing

Every day, we get bombarded with ads from brands trying to sell this and that. For the most part, as the general public, we don’t take notice of it (or we subliminally take it in). Content marketing is the breath of fresh air that we’ve all craved, pushing old tactics back to where they belong (in the bin) and bringing authentic connections to the forefront.

In a nutshell, content marketing focuses on delivering readers an answer to their problem. Whether that is in the form of a list-based article, or an infographic of a case study – the content is there to achieve one purpose: to solve challenges.

In the financial space, this is no different. But because of the competitive nature, it requires a much more strategic mindset, one that’s a step ahead of other efforts.

Mastercard has been creating high-quality, thought leadership video content for Youtube for years. And it pays off.

Consider this. You’re a 28-year-old millennial looking to take on a mortgage and become a first home buyer. The market is overwhelming, there are a lot of ‘promises’ floating around in the marketing sphere and there are so many options being blasted your way. You’ve got a plethora of choices to select from, but none of which you can confidently say you trust. If you had to test yourself, you wouldn’t be able to pin a brand to each message – they all seem so alike.

Until you pop online one morning, over your skinny cappuccino, and notice a bank serving up hot tips in an in-depth guide to house deposits. You give it a read, it does the job – you’re intrigued. You bookmark it and go on with your day.

The next morning, the same bank offers a podcast episode that specifically tackles the first home buyer market and trends for the month. You put your headphones in. By the end of the week, you’ve made contact with the bank, simply because they took the time to deliver you nurturing, non-invasive content that provided value. It gave you an answer to your problem, without just shouting at you to get in touch.

This is the marketing mix that all financial businesses need to take on: a subtle, gentle, careful approach to nurturing an overwhelmed audience.

Why choose content marketing over other efforts?

Recently, Kapost conducted a study that revealed content marketing typically has a lower upfront cost and more beneficial benefits longer term, than that of paid search advertising.

Because this form of marketing is there to solve a problem to a solution, results are generally more compounded. A solid article or downloadable eBook will continue to build traction with no additional investment required. And it’s not just all about traffic – in fact, conversion rates are up to six times higher than other traditional marketing avenues. Yikes!

How to plan your content out

No matter how big or small you are as a financial business, your content marketing mix must be balanced. A well-structured, accessible article will do far better than a short slab of text with zero headings or pointers for the reader. Beyond this, knowing the purpose behind each piece is critical. In order to compile all of this together, take the following steps when you’re ready to get planning:

- Research: This field is all about answering the biggest and most common questions. Explore what people are asking online and use your editorial calendar as a means to answer each of them. A great way to do this is by using KeywordTool.io to check out what the top questions are. Beyond this, though, have a look at Reddit, Quora, Medium, and social media to see what people are talking about. How can you tap into these conversations and make a mark?

- Map out: Once you know why you’re creating content and for whom, establish a regular schedule that’s unique. This should be a clear roadmap of your objectives and actions, so you know what you can expect. Tick off items as you progress and analyze your success with each of them.

- Newsjack: Remember that the financial industry is highly reactive. There’s always a lot of news going on within it and lots of political opinions floating around. Tap into these by monitoring news publications and online conversations, and make use of when these discussions are trending. Note key dates down in a calendar that you know you’ll be able to create content around – this is a great way to stay relevant.

- Create: As a be-all and end-all, your content needs to be clear. If the reader can’t actually pinpoint what they were told by the end of it, or can’t identify your main message, then there’s a problem. When you sit down to craft any form of content, keep the purpose and audience in mind. When you’re done, reassess it to see if it’s unique enough. Remember, the aim for businesses in this industry is to be different.

- Promote: One of the biggest misunderstandings from businesses of all industries publishing content, is that it will instantly receive engagement. Incorrect. Do the hard yards into getting your work seen and you’ll reap the benefits of higher interaction and conversions. Don’t expect miracles by sitting stagnant.

Above all, enlist the help and resources when you need it

As a financial business, you’re kept busy each and every day. The market is fast-paced and the industry is unforgiving. To keep up, you have to be on your feet. Unfortunately, content marketing requires the same level of attention, so if you’re overwhelmed by the amount of work to be done, employ the help of an expert or agency that can provide you with top-level services.

If you’re not sure where to get started, contact Digital Eagles to see how we can help you get your venture off the ground, all using high-quality content marketing.